How Do Checks Work

How Does a Check Work? - Synonym

The person drafting the check usually writes out the name of the recipient of the funds, the amount and the date, and then signs it. In some cases, the person may provide the authorized signature, and another party may fill out the amount and recipient for the check. Both ways are acceptable. 2 Receving the check

https://classroom.synonym.com/check-work-24469.html

What is a check and how does it work? - Everything Finance

The first is the routing and transit or ABA number. This number identifies the financial institution. The next number represents the checking account. At many institutions, this is your account number. The final number is the number of your check. It matches the check number usually found in the upper right corner of the check.

https://everythingfinanceblog.com/861/what-is-a-check-and-how-does-it-work.html

How do checks work? - Quora

Each check must have the name of the bank it’s drawn on,Signature of the person who is authorized to draw on the account, an account number, a person to pay the funds to, a valid date, and the amount to be paid written out in full and in numbers on each check to be a valid check.

https://www.quora.com/How-do-checks-work

Check Processing: What Happens When You Write A Check? - WalletHub

When you write a check, the payee deposits the check to his or her bank, which then sends it to a clearing unit such as a Federal Reserve Bank. The clearing unit then debits your bank’s account and credits the payee’s. From there, the check returns to your bank and is stored until it’s destroyed.

https://wallethub.com/edu/check-processing/14282

eChecks: Guide to Understanding How Electronic Checks Work - PaySimple Blog

With an eCheck, the money is electronically withdrawn from the payer’s account, sent via the ACH network to the payee’s banking institution, and then electronically deposited into the payee’s account. This is all done similar to paper check processing, just electronically. 4. What Types of Payments Can You Make with eChecks

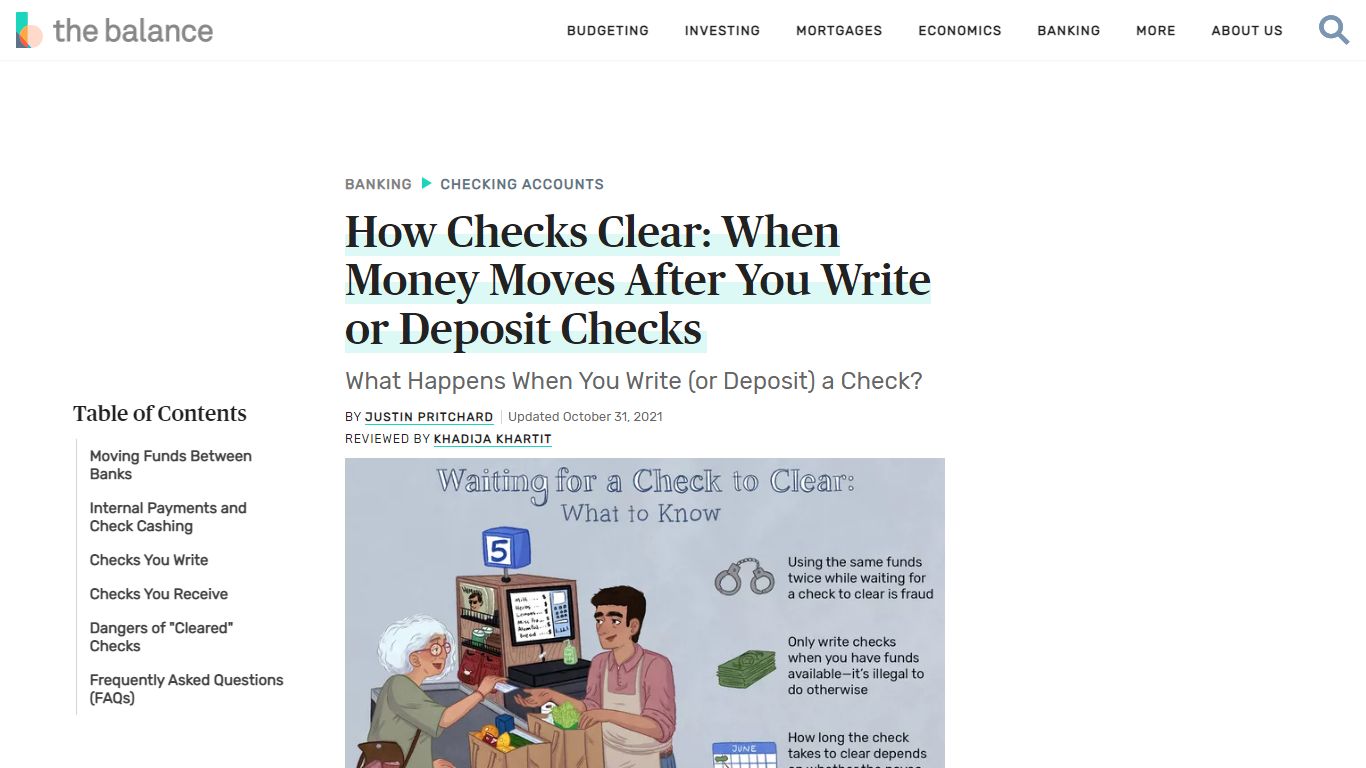

https://paysimple.com/blog/how-do-echecks-work/How Checks Clear: How Fast Money Moves After Deposit - The Balance

Logistically, the receiving bank or credit union (where the payee deposits or cashes the check) sends the check to the bank that the funds are drawn on, or to a clearinghouse. Banks originally sent physical checks to each other, but they increasingly use images of checks instead for improved efficiency.

https://www.thebalance.com/basics-of-how-checks-clear-315291

How Checks and Balances Work in the US Government - PrepScholar

Here’s how the system of checks and balances works in practice in the United States: one branch is given the power to take a given action, and another branch (or branches) is given the responsibility to confirm the legality and appropriateness of that action.

https://blog.prepscholar.com/checks-and-balances-definition-examples

How To Use Bank Checks - And Are they Even Still Relevant? - Money Under 30

How do checks work? They’re instructions for you bank A check is a written set of instructions for your bank, telling them to transfer a certain amount of money from one account to another. The speed of this transfer depends on the transaction. A check written to a business should be processed electronically and quickly, often within 24 hours.

https://www.moneyunder30.com/how-to-use-checkbooks

How Do Background Checks Work 📁 Aug 2022

How Do Background Checks Work - If you are looking for an easy way to find out more about someone you know then try our service first. free background checks, how do background checks work guns, how do background checks work at gun shows, how do background checks work for employment Lahore, Peshawar, Multan, Rawalpindi, Wah Cantt, Azad Kashmir ...

https://how-do-back-ground-checks-work.recordsfindhj.com/

What is a cashier's check & how to use one? | Capital One

You can head to your local bank and explain to the teller that you need a cashier’s check and what you are going to use it for. The teller will check that you have the funds to cover the amount. If you have a checking account at the bank, the amount you need for the cashier’s check will be taken out of your account.

https://www.capitalone.com/bank/money-management/banking-basics/using-a-cashiers-check/